Last Call: Only 2 Days Left to Deduct Your Business Cards and Marketing Materials!

As the final days of the year approach, real estate professionals have a golden opportunity to not only enhance their brand but also enjoy significant tax advantages. The secret? Investing in essentials like business cards, office supplies, and marketing materials before the calendar resets. These expenditures are not just vital for daily operations—they are 100% tax deductible, offering a double benefit of functionality and financial savings.

Let’s delve into the advantages of seizing this tax-saving window, with a focus on how new custom Realtor business cards from realty-cards.com, as well as all you other advertising and marketing materials, can be a deductible asset. Time is of the essence, so let’s explore why quick action is imperative.

The Year-End Tax Advantage

The conclusion of the calendar year presents a critical period for real estate professionals to strategically allocate resources. Costs incurred on business cards, office supplies, and marketing materials not only support day-to-day operations but also come with the added perk of being fully tax deductible. By leveraging this tax advantage, realtors can lower their taxable income, ultimately reducing their overall tax liability. This financial incentive makes the investment in business essentials a smart move before the year concludes.

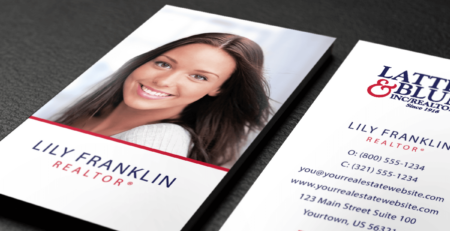

For real estate agents, a distinctive and memorable business identity is crucial. Enter realty business cards — an often overlooked deductible asset. Realty-cards.com specializes in creating custom business cards tailored to real estate professionals’ unique needs. Investing in high-quality, custom realtor business cards not only reinforces your professional image but also ensures your contact details are readily available to potential clients. The customization options provided by Realty Cards allow realtors to showcase their individual brand identity, standing out in a competitive market.

Moreover, real estate marketing materials are indispensable in the real estate industry, and with the year-end tax advantage, investing in these materials becomes even more enticing. From brochures and postcards to branded apparel, realty-cards.com provides a comprehensive suite of solutions to elevate marketing efforts.

Act Quickly: The Countdown is On

The urgency of this tax-saving opportunity cannot be overstated. As the year draws to a close, the window to capitalize on these deductions is rapidly shrinking. Waiting until the last moment may result in rushed decisions and a compromised selection of business essentials. By acting swiftly and making these essential purchases before the year-end deadline, real estate professionals not only ensure eligibility for tax deductions but also position themselves for a fresh start in the upcoming year. Planning ahead and investing wisely in business cards, office supplies, and marketing materials sets the stage for success in the months to come.

Realty Cards are the go-to experts, recognizing the distinct needs of real estate professionals. Offering a user-friendly interface, extensive customization options, and high-quality products, Realty Cards is committed to helping realtors make a lasting impression. Whether in need of eye-catching business cards to leave a memorable first impression or marketing materials to showcase property portfolios, we has you covered. Our company’s dedication to quality ensures that your investment not only serves its immediate purpose but also contributes to the long-term success of your real estate endeavors.

As the calendar year comes to a close, the financial advantages of investing in business essentials, especially realtor business cards, cannot be overstated. The opportunity to make these purchases fully tax-deductible adds an extra layer of incentive, making it a strategic move for real estate professionals looking to optimize their financial position. Realty Cards stands out as a valuable partner in this year-end endeavor, offering realtors the tools they need to make a lasting impression. By acting quickly and making these essential purchases before the year-end deadline, real estate professionals not only position themselves for a tax advantage but also set the stage for a successful and prosperous new year. Don’t let this opportunity slip away—invest wisely in deductible realtor business cards and reap the rewards in the months to come.

Did You Know That Branded Real Estate Apparel Is Tax-Deductible Too!

In the race to maximize year-end tax advantages, don’t overlook a hidden gem—the deductibility of your branded real estate apparel. Beyond making a stylish statement, these garments are considered legitimate business expenses by the IRS, offering you valuable tax deductions. Whether it’s a logo-emblazoned polo or a personalized jacket, the costs of these items, from purchase to maintenance, can be deducted from your taxable income, reducing your overall tax liability. When it comes to tax deductions, the Internal Revenue Service (IRS) allows businesses to deduct ordinary and necessary expenses incurred to run their operations. This includes the cost of uniforms and work clothes, and for real estate professionals, branded apparel falls squarely into this category.

Your real estate-branded clothing isn’t just a style statement; it’s a marketing tool. Whether it’s a polo shirt with your agency’s logo or a jacket embroidered with your personal brand, these pieces contribute to your professional image and help create a lasting impression on clients. And the best part? The cost of purchasing and maintaining these branded garments is considered a legitimate business expense, making it eligible for tax deductions.

With the year-end deadline fast approaching, the window to maximize deductions on your branded real estate apparel is closing. Acting now allows you to not only enhance your professional image but also position yourself for a healthier financial outlook in the coming year.

15 More Tax Write-Off’s You May Have Missed

The following expenses are tax-deductible because they are essential to the functioning of your realty business. And these aren’t the sole write-offs available! Continue reading for a compilation of common deductible expenses for real estate agents.

1. Realtor Dues & Subscriptions:

- Write it off using: Schedule C, Box 27a

- Any dues, fees, or subscriptions for a realtor’s association or the MLS can be deducted.

2. Property Promotion:

- Write it off using: Schedule C, Box 8

- Marketing materials like postcards, property signs, and even ads can be written off.

3. Seminars & Workshops:

- Write it off using: Schedule C, Box 27a

- Coaching, seminars, or workshops used to maintain your work-related skills can be written off.

4. Website & Hosting Fees:

- Write it off using: Schedule C, Box 8

- Squarespace, Wix, GoDaddy, and other website service fees are fully tax-deductible.

5. Legal Fees:

- Write it off using: Schedule C, Box 17

- Legal fees paid to set up your business or draw up paperwork are deductible.

6. Licenses and Fees:

- Your state license renewal, MLS dues, and professional memberships are deductible.

7. Commissions Paid:

- Write it off using: Schedule C, Box 10

- Commissions you pay to employees or other agents are fully deductible business expenses.

8. Desk Fees:

- Write it off using: Schedule C, Box 10

- The fee you pay to rent a desk at your broker’s office or a coworking space is tax deductible.

9. E&O Insurance:

- Write it off using: Schedule C, Box 15

- Errors and Omissions insurance is required for all real estate agents and is deductible.

10. Lead Generation Software:

- Write it off using: Schedule C, Box 18

- Software for CRM, lead generation, or email marketing is a write-off.

11. Business Cards:

- Write it off using: Schedule C, Box 8

- Business cards with your contact information count as advertising expenses.

12. Office Supplies:

- Write it off using: Schedule C, Box 18

- Deduct anything you buy for your office, like pens, binders, folders, printer ink, or a whiteboard.

13. Phone Bill:

- Write it off using: Schedule C, Box 27a

- If you use your phone for work (who doesn’t?), then a part of your phone bill is tax-deductible.

14. Advertising:

- Write it off using: Schedule C, Box 8

- Print and online advertising costs for your business are considered write-offs.

15. Creative Assistance:

- Write it off using: Schedule C, Box 11

- If you need to hire an editor, designer, photographer, or other creative pro, write off what you pay them.

Realty Cards is the industry leader in designing and printing quality real estate marketing materials, apparel & promotional items, and we would love the opportunity to work with you on providing quality promotional materials for your business!